In-depth Guide on the Sales Process for 2020

Our new research highlights some surprising sales statistics on sales processes and the current climate faced by sales professionals.

Sales Statistics Research Report Analysing a Survey of Sales Professionals

Possibly due to the lack of a directly related university degree, and some comedy stereotypes, sales is often belittled as a profession and gets poor PR. Yet salespeople represent a sizeable chunk of our workforce, some 12% in the UK, and can command high salaries.

Sales is a talent-based profession where experience and aptitude are generally recognised above any specific qualifications. In many industries, especially technology, it is salespeople, and not the technicians or accountants, who are generally running the business.

However, whereas in other professions, such as accounting and marketing, where there are set principles and regulations to guide the strategies and tactics, sales can be an autonomous process with methods varying from industry to industry and salesperson to salesperson. This means best practice principles are largely underreported, leaving the profession with limited sales statistics to learn from and to generate innovation. This has led to a global skills shortage that is reportedly limiting productivity.

Sales Professionals Research 2020

In July 2020, the cloud-CRM developer and vendor, SpotlerCRM, conducted a research project, surveying sales professionals globally to generate useful sales statistics data on their practices. The online survey was promoted to the company’s own customer base, to business groups via social media, and using the SurveyMonkey Audiences tool. SpotlerCRM customers account for around one-third of responses which would suggest the data is biased towards existing CRM users and the B2B market.

Research Data

168 respondents participated in the research, incentivised with a business credit in the subsequent reported article (see below). Over 50% have worked in sales for more than 5 years, with 48% in the B2B market and 40% with a combined B2B and B2C audience. The respondents represent more than 35 industry sectors, with the largest group being technology at 16%.

Headlines

Report Analysis

This report looks at each question asked in the survey and assesses the sales statistics collected. It looks to interpret the results in the current environment and evaluate the market influences.

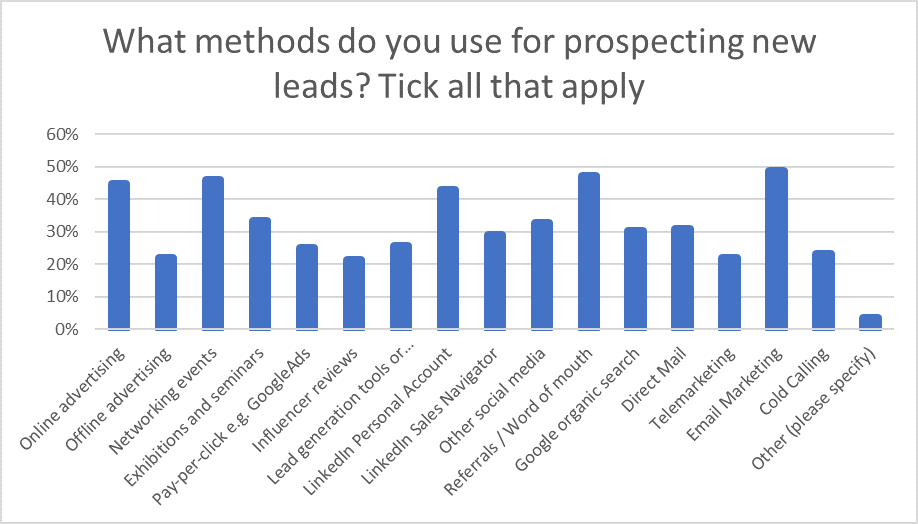

Q1. What methods do you use for prospecting new leads?

The first question asked about the methods used to prospect new leads, with the audience asked to select all the options that applied from a list. The prospecting method with the highest use was stated as email marketing at 49%, with the more traditional methods of referrals and networking only a few percentage points behind, at 47% and 46% respectfully. However, the newer digital methods of online advertising at 45%, and using the social media platform LinkedIn at 43%, were also highly favoured.

These results show a combination of proactive and reactive sales prospecting. There is an increased propensity for proactive sales, which suggests the audience has a higher value product/service and an easily identifiable target market, as highlighted in question 14 below.

Interestingly, the sales statistics also show that 23% of salespeople use cold calling for lead prospecting and 22% use telemarketing. These cold sales approaches, as well as cold email marketing and list buying, are contrary to the European Union’s (EU) data protection legislation, GDPR, that was introduced in 2018. This regulation applies to all EU based citizens, regardless of the whereabout of the prospecting organisation. While the location of responders or that of their target audience were not recorded in the survey, we might consider that despite the publicity surrounding the implementation of GDPR, the legislation has been largely ineffective.

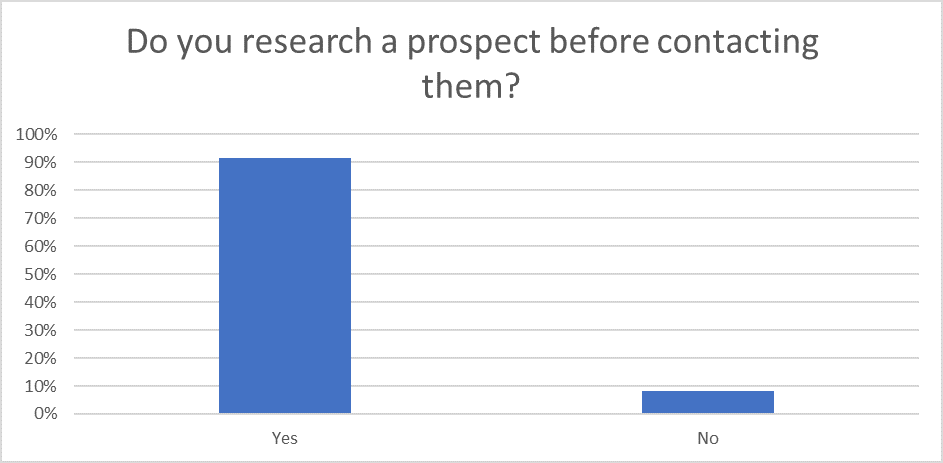

Q2. Do you research a prospect before contacting them?

Q3. If yes, what research do you do before contacting the lead?

Questions 2 and 3 asked about what, if any, research the salesperson carried out before contacting a new lead. Bearing in mind that 8% of respondents worked in retail sales, a positive response of 92% suggests a high level of professionalism in researching prospects.

Most respondents, 77%, said their first port of call was the prospect’s company website, followed by viewing the individual’s LinkedIn profile at 63%. In addition, 43% said they checked the lead’s social media activity and 42% their company’s registration record.

This indicates the prominence of social media in today’s sales environment for anyone who doubted its impact. LinkedIn, especially, has become the B2B go-to directory for not only finding new customers but to verify the intent and importance of sales leads. In 2020, LinkedIn proclaimed over 700 million members with nearly 47% active monthly users, so the chances are that your customers are using it.

As we can see from the responses to questions 1 and 2, LinkedIn personal accounts are used as a tool for prospecting new leads as much as online advertising, email marketing, referrals and networking events (at 43%), and also for researching leads at 63%. This means that maintaining an active professional profile is desirable, but the actual focus should be on the personal accounts of people who are selling products or services via LinkedIn.

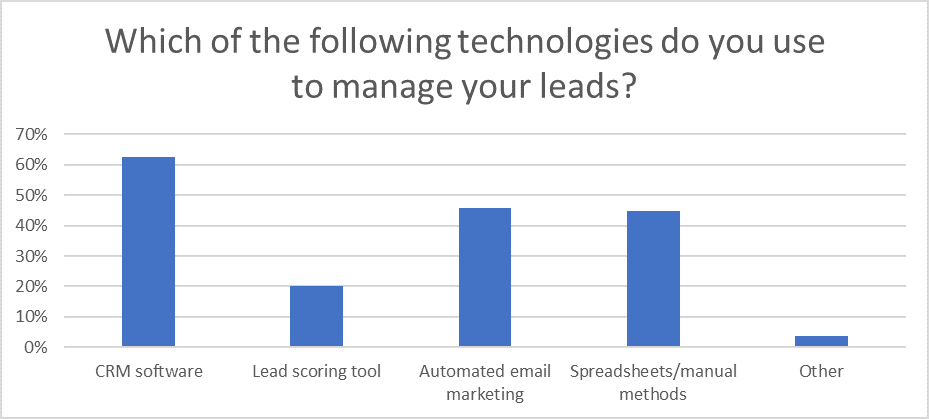

Q4. Which of the following technologies do you use to manage your leads?

The survey went on to ask which technologies were used to manage leads, again inviting the audience to select all the options that applied from a list. Unsurprisingly, the majority stated that they used a CRM system at 63%. Yet, given that around a third of the respondents were existing customers of SpotlerCRM, this actually suggests a low use of customer relationship management software.

This is substantiated by the numbers who said they managed their leads using spreadsheets and manual methods at 45%. This is higher than previous sales statistics that found that around 33% of UK businesses didn’t use CRM software. Although, as multiple responses were permitted, some may be using manual methods alongside other tools.

While this indicates a bright future for CRM, it highlights the increasing digital divide between the technology haves and have-nots. However, there is also evidence that small businesses stand to benefit as they can be more agile in adopting new technology.

The All-Party Parliamentary Group for Professional Sales in partnership with the Association of Professional Sales, published a report in October 2019, detailing an inquiry into the role of sales in increasing the productivity of small and medium-sized enterprises in the UK. It stated that “Failure to take up digital technology is one of the starkest differences between highly productive firms and firms with stagnant productivity.”

Its research showed SMEs that have embraced digital technologies have average productivity levels 13.6% higher than those which have not. It also found that using CRM software provides an average 18.4% increase in sales per employee.

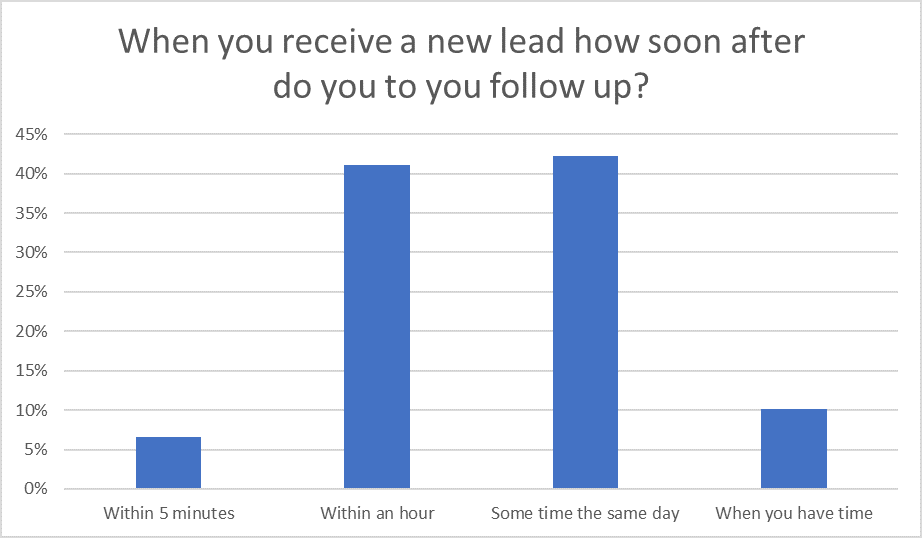

Q5. When you receive a new lead how soon after do you to you follow up?

One of the biggest questions for sales today is how soon you should follow up and how, with differences of opinion across different cultures. For example, in the USA where the sales profession is more highly valued, it is normal to get a quick response, with a salesperson calling back almost immediately. In the UK, this is a less welcome approach, although a fast email response is generally appreciated.

The research showed that 90% of sales professionals responded to new leads on the same day, with 41% getting in contact within one hour and 7% within 5 minutes. While this might seem excessively speedy, if they are referring to automated email marketing then this would not be unusual.

With the rise of CRM software and integrated email marketing tools, new leads can be automatically added to a campaign and mailed in a matter of seconds. The new lead’s response to the automated message then provides the initial opportunity for lead scoring, providing the first stage of lead qualification that informs the salesperson of their level of intension.

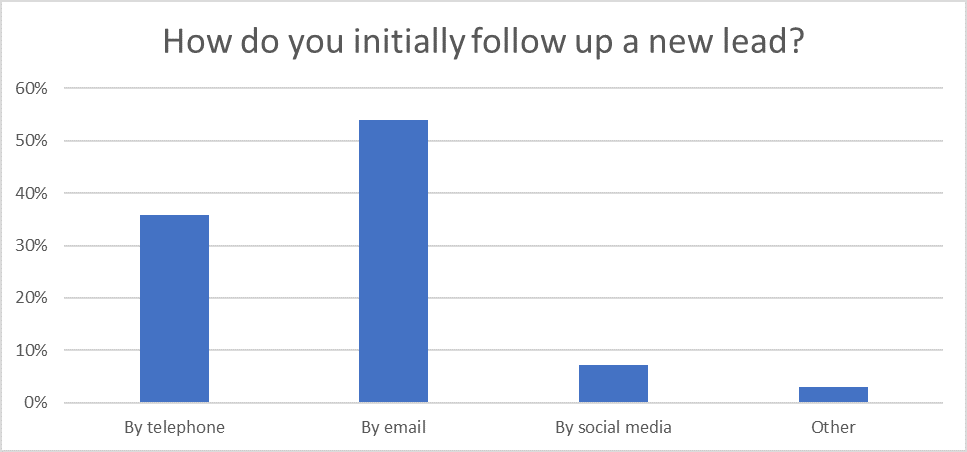

Q6. How do you initially follow up a new lead?

Whether using automated email marketing campaigns or not, more than half of salespeople at 54%, claimed they responded by email, with most others preferring the salesperson’s best friend, the telephone at 36%.

With the increase of internet-based technologies there has been a trend away from telephone sales. Yet if you want to build a relationship with a prospect and get your personality across, picking up the phone can fast-track the process. However, not all prospects are receptive to calls and finding the right balance is a skill in itself. Making, an appointment to call or demo a product can help make calling less intrusive.

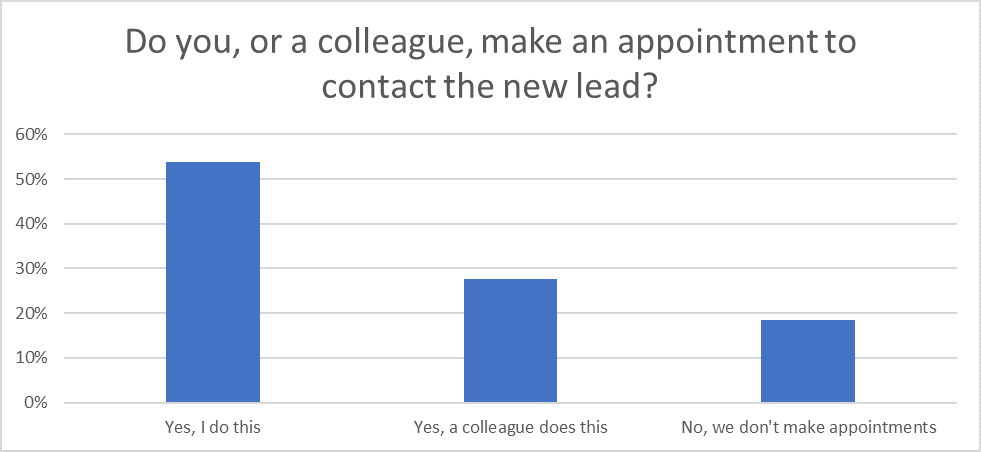

Q7. Do you, or a colleague, make an appointment to contact the new lead?

Asked if they made appointments with new leads, over 80% said they did. Most, at 54%, made the appointment themselves, and 28% used colleagues to set up the appointment for them.

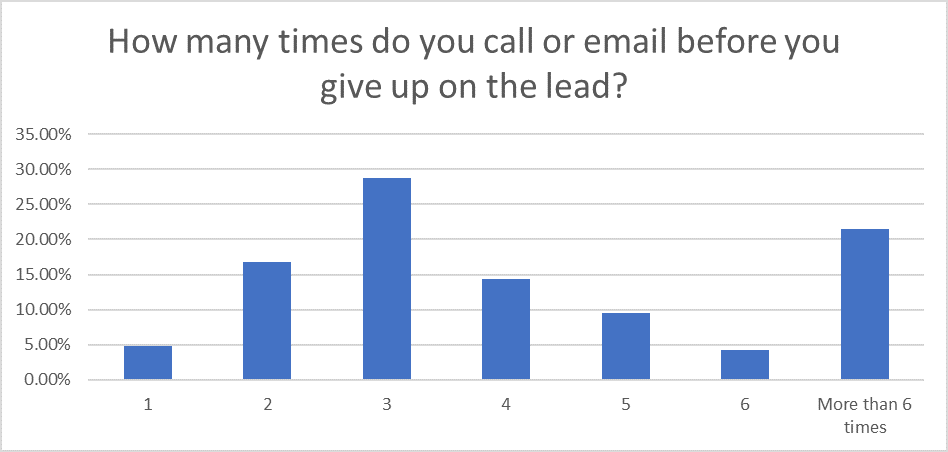

Q8. How many times do you call or email before you give up on the lead?

Probably the most controversial subject for salespeople is how many times to call or email before you give up on a new lead. Undoubtedly, this will be determined by the industry sector, value of the deal, and maybe the contact’s initial method of enquiry. In the easy-in, easy-out, SaaS environment, it’s likely the tolerance on both sides is low. Whereas in other sectors sales professionals may keep trying for much longer – or until the lead gives in!

Most commonly, at 29%, the survey showed that salespeople would call or email up to three times before giving up, yet the second highest response of 22% said they would keep trying for more than 6 times. This correlates to question 12, with regards to the average sales value. There is obviously more incentive to try harder to win a deal worth 100k than one worth 1k.

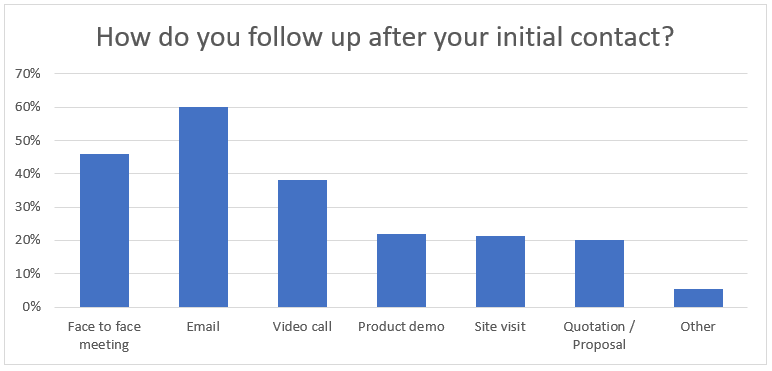

Q9. How do you follow up after your initial contact?

Looking at the follow up communication, where respondents were asked to select all that apply from a list, 60% of salespeople use email to contact the prospect. However, 46% said they set up face to face meetings and 38% use video calling. As the research was conducted during the Covid-19 pandemic period in July 2020, it is likely that a higher number of video calls were recorded than in previous times. The ease with which remote workers have adapted to this suggests video will be playing a larger role in our sales processes for the foreseeable future.

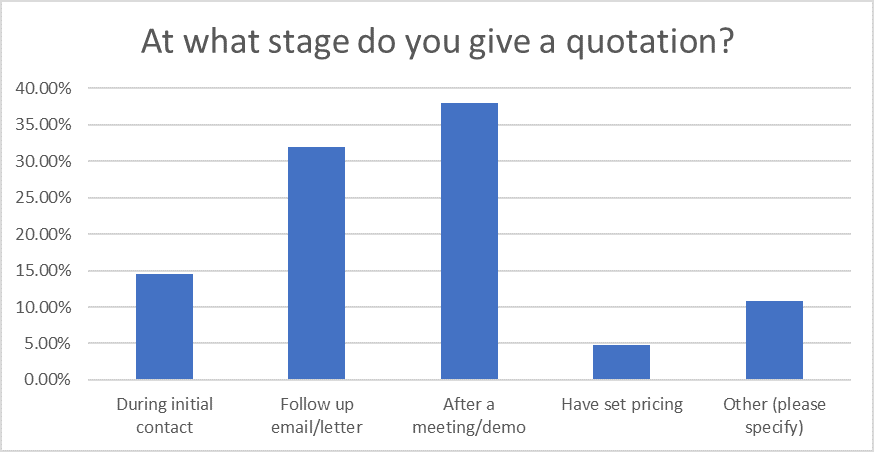

Q10. At what stage do you give a quotation?

Question 10 asked at what stage did the salesperson provide a quotation to the prospect. For some 10% this was not relevant, stating that they have set pricing or did not give quotations. For 70% of salespeople it was found that a quotation was given in the follow up communication after the initial response to the enquiry. This indicates the importance of sales qualification and understanding the prospect’s needs prior to setting the price. In addition, some companies keep their pricing confidential (or opaque) and won’t quote before qualifying the prospect, or at least sensing what their budget might be!

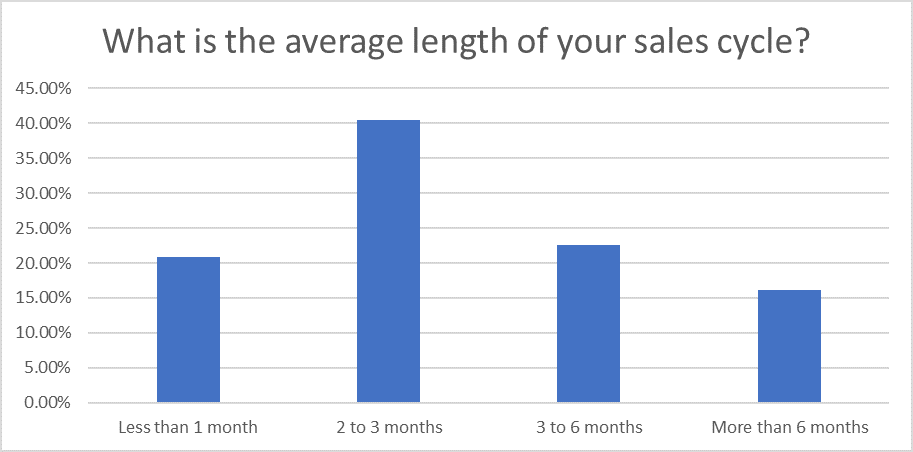

Q11. What is the average length of your sales cycle?

The length of the sales cycle is an important part of the sales process and generally sales statistics suggests this is relative to the sale value, i.e. the higher the cost, the longer the sales cycle. Most commonly, 41% of salespeople stated that their sales cycle lasted an average of 2 to 3 months. 23% had sales cycles of 3 to 6 months, 21% of less than a month and 16% of more than 6 months. This again, draws a parallel with the average sale values shown in question 12.

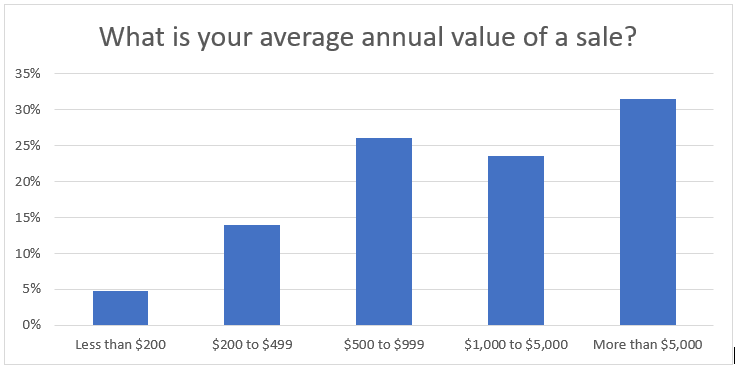

Q12. What is your average annual value of a sale?

Asked the average value of a sale, 32% stated more than $5,000/€5,000/£5,000. By itself, this is not an indicator of high or low price as this will be dependent on the product, service or industry. For example, $5,000 is a cheap car but an expensive watch.

With a significant number of B2B organisations represented in the survey it is likely that many deals would be well above the $5,000 plus threshold used. As already reported, the responses here do help qualify the results found in previous questions regarding the persistence of sales professionals and the length of the sales cycle.

In filtering the results by the average value, we see some dramatic variances in those who stated their average annual sales value was more than $5,000/€5,000/£5,000.

Obviously, price is a strong determining factor in how the sale process is managed.

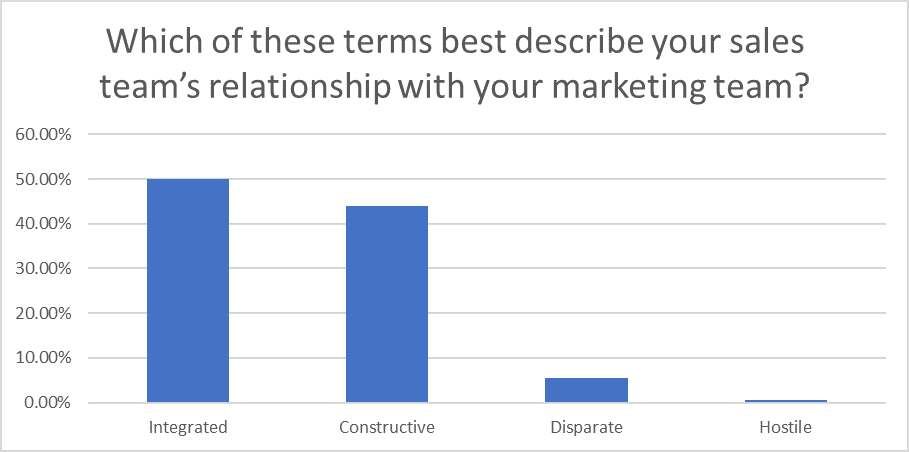

Q13. Which of these terms best describe your sales team’s relationship with your marketing team?

We often talk about the need to align your sales and marketing teams to meet the challenges of a rapidly-evolving marketplace. So, it’s exciting to see that 50% of sales professionals considered their teams are integrated and a further 44% have a constructive relationship. This is good news for sales and marketing.

Effectively, sales and marketing are aspects of the same process. Marketing’s role is to create a steady stream of qualified leads, and the task of sales is to convert these leads into clients and customers. Aligning departmental strategies is crucial for developing a team that is ready to face the challenges of the modern marketplace, and this is where CRM software comes into its own.

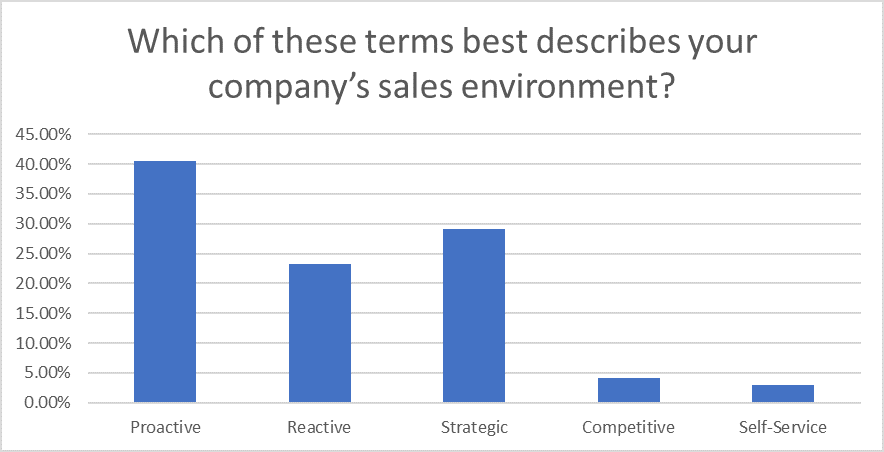

Q14. Which of these terms best describes your company’s sales environment?

Next, the survey asked about the sales environment, which is generally dependent on the industry sector and business model. 40% described their environment as “proactive”, followed by 29% “strategic” and 23% “reactive”. The volume of proactive sellers suggests the majority of responders have a high value offering and are easily able to identify their target audience. In a reactive environment, the opposite will be true and this result fits with the findings of question 22, where we see that 16% of responders are in the technology sector and 8% in retail.

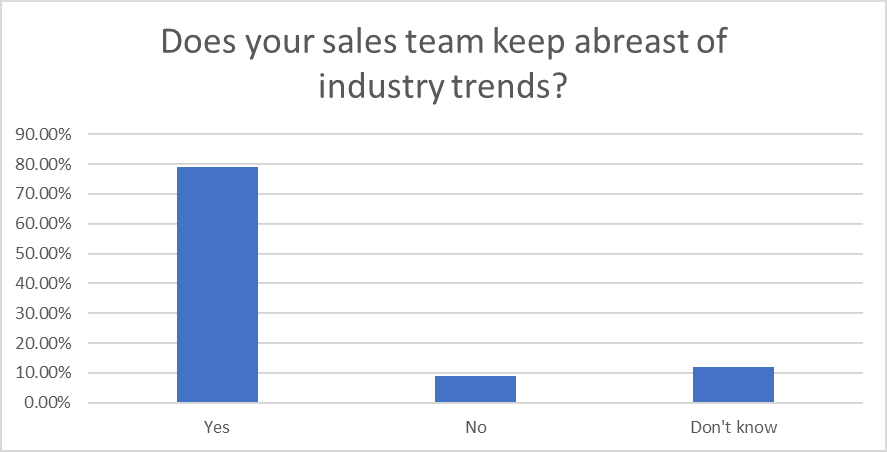

Q15. Does your sales team keep abreast of industry trends?

Keeping up with industry trends can be time consuming, especially when your priority is selling. Yet it is good to see that nearly 80% of sales professionals do make the time to keep abreast of what’s happening in their sector. Less than 9% do not monitor trends, and 12% responded “don’t know” which may mean they are not directly sales related, and suggests they don’t keep themselves up to date with what’s happening within their organisation let alone externally!

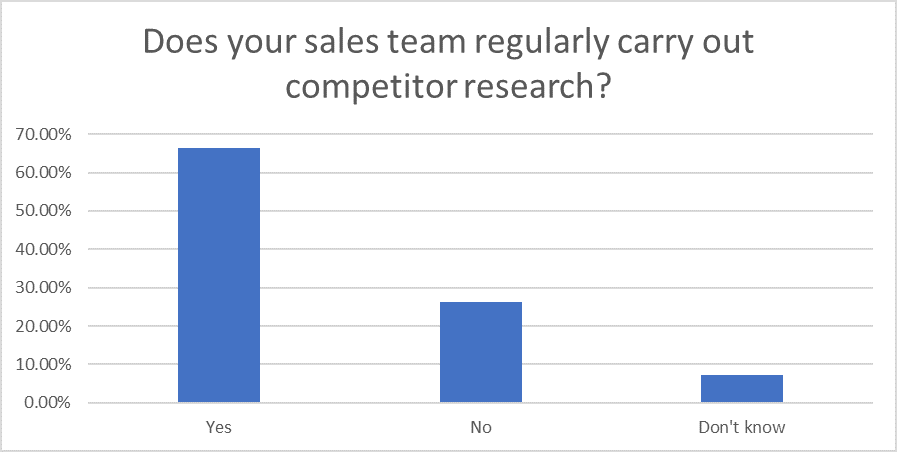

Q16. Does your sales team regularly carry out competitor research?

While it is more likely that a company’s marketing team would run any regular competitor analysis, it’s essential that salespeople understand where their value proposition sits in their micro-environment. 66% of sales professionals said their team does carry out regular competitor research, yet a worrying 26% said they do not.

With more than a quarter not running competitor research, it is likely this will impact on their ability to sell. This may be related to the lack of confidence in their product price, for example, as shown in question 17 and hinder their sales effort.

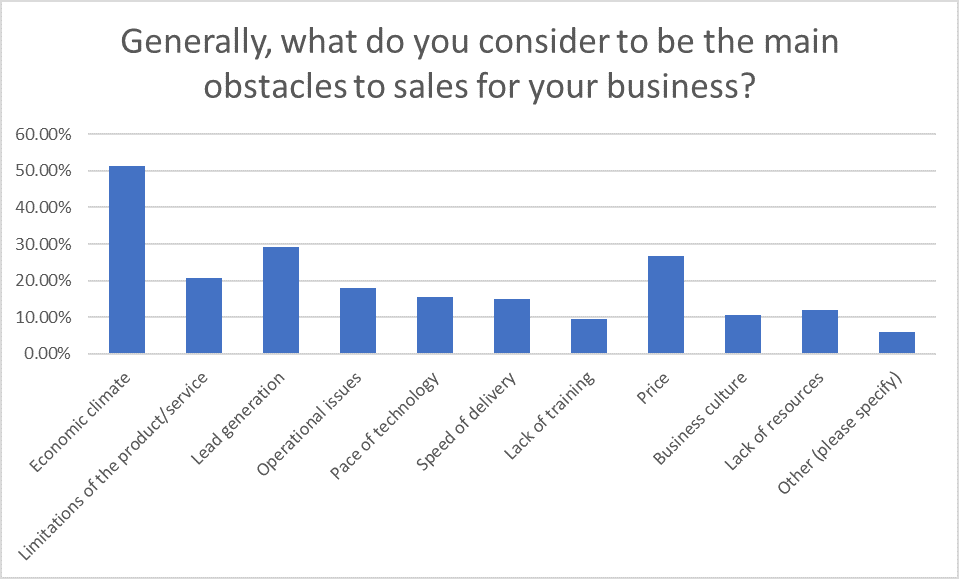

Q17. What do you consider to be the main obstacles to sales for your business?

Asked about the main obstacles to sales for their business, unsurprisingly, the economic climate was thought to be mostly to blame and sited by 51% of sales professionals. With the survey conducted during the Covid-19 pandemic, every organisation is currently experiencing economic disruption in one form or another and will have influenced these sales statistics.

However, the results also showed that lead generation is an issue for 29%, and product price for 27%. If related, this may suggest that we will see prices drop in some sectors over the coming months as businesses look to drive more sales to maintain cash flow at the expense of profit margins.

Interestingly, given that 16% of responders are in the technology sector, that the choice “limitations of the product” does not rate higher, as this is a common excuse for salespeople in the sector. As mentioned in question 16, price is generally a matter of being a good negotiator and knowing your competitors.

Q18. What is your favourite sales tactic?

Our experienced sales professionals offered some interesting insights when asked for their favourite sales tactics. Most commonly they responded that the trick was to build long and lasting relationships with the customer – good news for CRM vendors! They also commented about the need to research the customer and understand their motivation to make a personal connection.

They said that understanding the customer as a person was all important, as well as being honest in their transactions. There was also agreement that it was important to have excellent product knowledge and to demonstrate competence.

Q19. What is your best advice for new salespeople?

Our sales professional had some great advice for anyone new to sales. Overwhelmingly, their best advice was to “be persistent” and “never give up”.

The next most popular area of advice was “to listen”. Andriy Haydash wrote: “Learn to listen and ask open-ended questions in a strategic way to get your lead talking about their business, problems and goals.”

But they also stressed the need for research and knowledge.

Another added: “Know what you’re talking about, research as much as you can and get as much knowledge as you possibly can. When you know the answer to many things you will come across as a very intelligent person who knows what they’re doing and it does rub off when it comes to sales, when the customer is confident with you, he or she will have the sale.”

Wise words indeed!

Research Audience

Finally, a few questions were asked to give context to the responders and the organisations they work for.

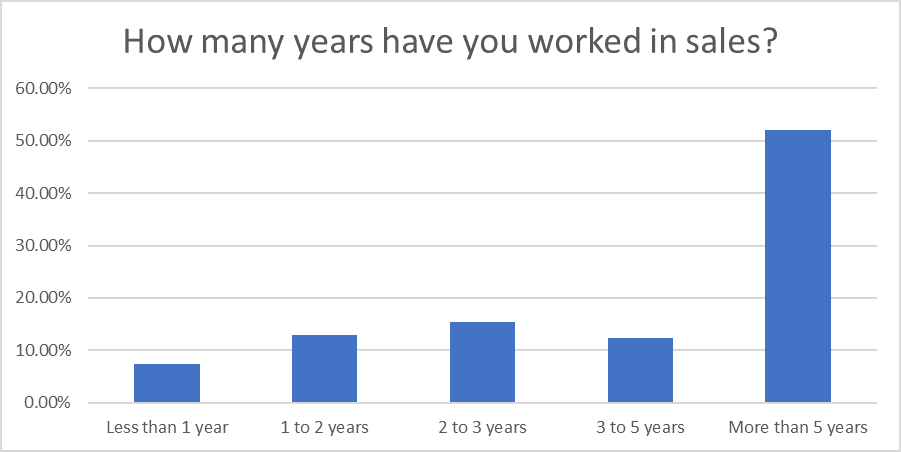

Q20. How many years have you worked in sales?

With 52% or survey responders having worked in sales for more than 5 years, this suggests the survey audience has a high calibre of experience and seniority in the field. It also shows that despite often being lowly regarded as a profession, sales is an interesting and rewarding one. While many might not consider sales as their career highlight in their early years, the flexibility and outward facing nature of the role can be a perfect choice for many.

When filtering the results by sales value the percentage of sales professionals who have worked in the field for more than 5 years increased from 52% to 87%.

While the survey did not ask responders their age, this data suggests that many sales professionals are mature workers with fewer young people coming into the profession. This is supported by the All-Party Parliamentary Group for Professional Sales report, previously mentioned, which highlights concerns for the skills shortage in sales and the lack of young people being encouraged to consider sales as a career.

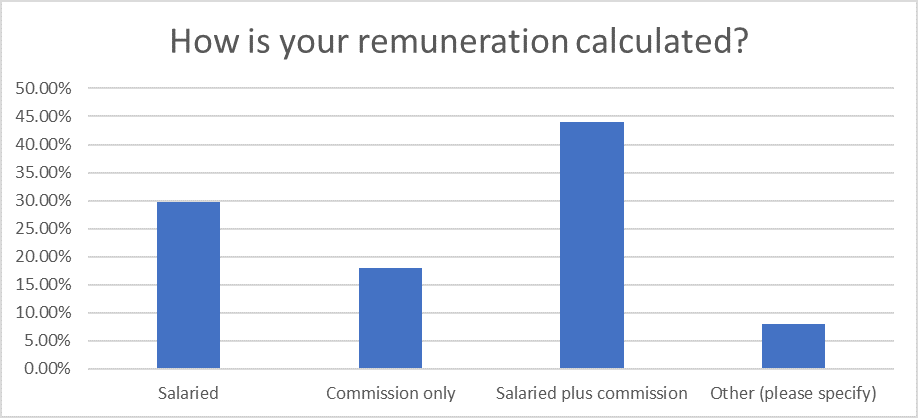

Q21. How is your remuneration calculated?

Looking at the renumeration packages of sales professionals, the option of a salary plus commission at 44% was most common. Interestingly, 29% said they were paid a salary only and 18% commission only. This suggests a move to a more structured environment for sales professionals and maybe less self-employment.

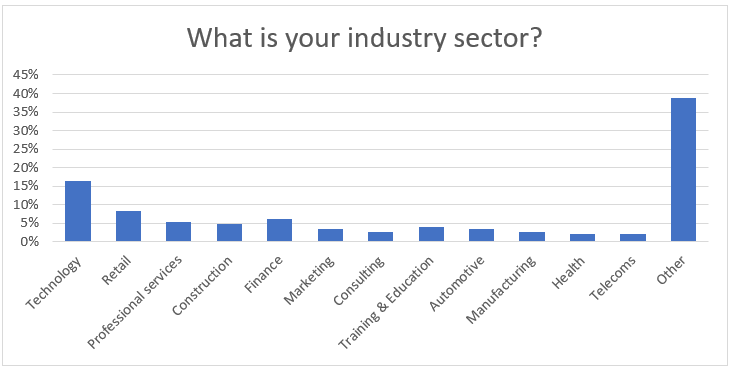

Q22. What is your industry sector?

The survey respondents came from more than 35 different industry sectors, though a sign of the times might be that the highest group at 16%, came from the technology sector. Other prominent sectors included retail at 8%, financial services at 6%, then with an equal 5% of the share was professional services and construction.

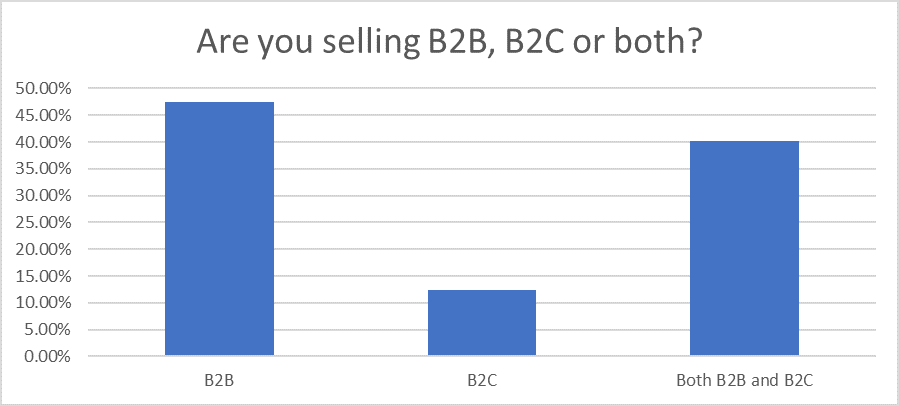

Q23. Are you selling B2B, B2C or both?

It is thought that in the UK some 40% of businesses operate B2B while 42% are a mix of both B2B and B2C. Our sales statistics research shows us that 48% are B2B and 40% include both, and just 12% are B2C only. However, as around a third of responders where existing customers of SpotlerCRM, whose CRM software is targeted at B2B businesses, this may have created a bias for B2B.

Summary

There is no doubt that the sales environment has been experiencing rapid change in recent years and that the traditional sales approach is outdated. Never more so has this been evident than in 2020 with the arrival of a global pandemic.

This research suggests that while many sales professionals have embraced the change and risen to the challenges faced, a significant portion may still be sticking their heads in the sand. In the retail sector, for example, it is plain to see where traditional stores have struggled to keep pace with technology, while others that have been hot off the mark have raced ahead. It is likely that other sectors will also face similar issues if they do not move with the times.

Technology Influences

With B2B, developments in technology have both blighted and enhanced the sales profession in equal measure. The customer has become increasingly more knowledgeable and this has increased their buying power. At the same time, social media has brought easy access to our target audience on mass, and video conferencing has provided the chance to network from our own homes.

The advent of cloud technology brings advantages, especially for small businesses, that were previously unimaginable. The affordability and simplicity of this web-based tech means that even the smallest of the small can compete with big corporations if they are agile in adopting new technology.

Customers in both B2B and B2C markets are now seeking a different experience. Some of this may be temporary, yet it is likely that the pandemic has brought about a foreshortening of change. What would have otherwise taken a few years to adopt has been thrust upon us in a matter of weeks.

Sales Agility

Adapting to the changing environment makes CRM even more critical to sales success than ever before, matching customer needs for tailored interactions and customised offerings. At the same time, the sales profession needs to earn greater respect to change the stereotypes of the past.

Understanding how the buyer’s journey has changed will help prepare sales professionals for the changing environment and adapt their approach. Fortunately, help is at hand with initiatives being developed to heighten the profile of sales and train a new generation of sales professionals in apprenticeship schemes.

It seems we are still human after all!

Contributors

A big thank you to everyone who took part in this research and especially those who gave their permission to be listed and quoted in the report.

APM Shopfitting | ||

Intelicare Ltd | ||

Objectives Reached | ||

Jaysand Limited | ||

Everything Leisure Ltd | ||

Stirling Holidays Ltd | ||

Risc IT Solutions Ltd | ||

AGl |

Really Simple Systems is now Spotler CRM

The same great technology, a CRM platform that is focused on the needs of B2B marketers, provided by the same great team, at a great price!